Introduction

If you are looking to cancel my timeshare mortgage, you are not alone. Many people find themselves burdened by escalating maintenance fees and limited booking availability. Here’s a quick answer to your immediate concern:

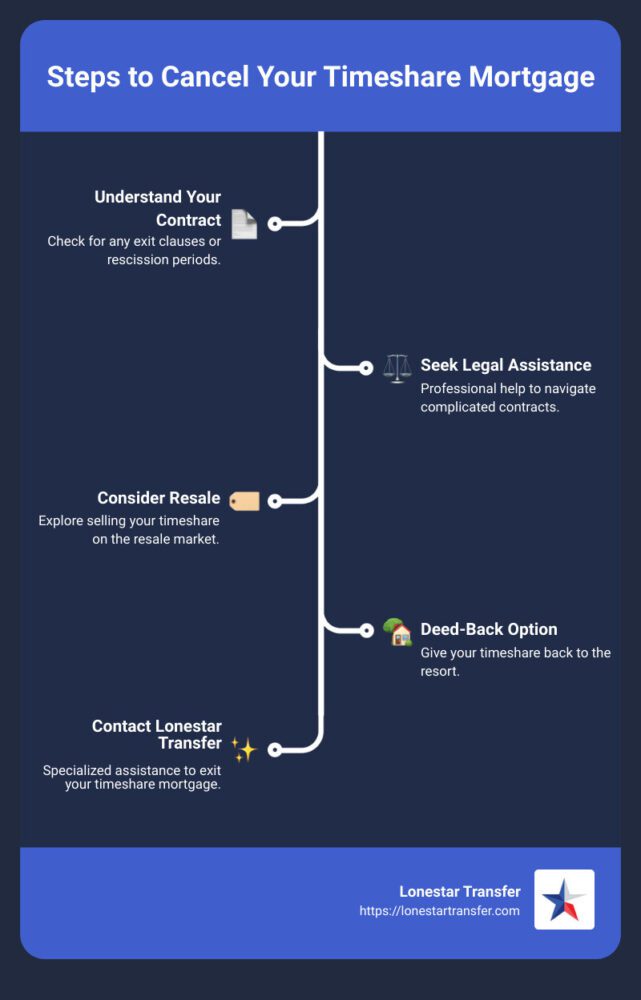

- Understand Your Contract: Check for any exit clauses or rescission periods.

- Seek Legal Assistance: Sometimes, professional help is needed to navigate complicated contracts.

- Consider Resale: Explore selling your timeshare is an option, however it is typically sold at a large loss. Unfortunately online broker or selling sites typically do not yield any results.

A timeshare might seem like a dream come true, promising idyllic vacations every year. But the financial burden can quickly become overwhelming. Escalating maintenance fees, unexpected special assessments, and the constant stress of securing dates make the initial excitement fade fast.

Imagine being stuck with a financial obligation that only grows, year after year. That’s the reality for many timeshare owners, who often find that the resale market offers little relief. The timeshare you bought at a premium price might depreciate faster than you’d imagined.

That’s where Lonestar Transfer comes in. We specialize in helping frustrated timeshare owners regain their financial freedom. With years of experience and thousands of clients successfully assisted, our processes are designed to get you out of that unwanted timeshare mortgage efficiently, permantently and legally.

Understanding Timeshare Mortgages

Timeshare mortgages can be complex, and understanding them is crucial if you’re considering canceling your contract. Let’s break it down.

What Is a Timeshare Mortgage?

A timeshare mortgage is a loan you take out to purchase a share of a vacation property. Unlike traditional real estate, timeshares operate on a shared ownership model. This means you own a fraction of the property and have the right to use it for a specific period each year. This concept is known as fractional ownership.

Fractional Ownership

With fractional ownership, you and other buyers share the property. For example, if you have a one-week timeshare, you own 1/52 of the property. This setup can seem appealing because it allows you to enjoy vacation property without the full cost of ownership. However, it comes with its own set of challenges.

Financial Commitments

Owning a timeshare mortgage involves more than just the initial purchase price. Many owners are caught off guard by the ongoing financial commitments, which can include:

- Mortgage Payments: Just like with a home loan, you’ll have to make regular mortgage payments. The interest rates can be high, especially if financed through the timeshare developer.

- Maintenance Fees: These annual fees cover the upkeep of the property, including repairs, landscaping, and utilities. The average maintenance fee is around $1,120 per year and can increase over time.

- Special Assessments: Sometimes, unexpected costs arise, such as major repairs or improvements. These are covered by special assessments, which can be a significant financial burden.

Maintenance Fees

Maintenance fees are a major part of the financial commitment in timeshare ownership. These fees are collected by the homeowners association (HOA) or the resort management to cover the general upkeep of the property. They can include:

- Plumbing and HVAC maintenance

- Electrical system repairs

- Landscaping and ground maintenance

- Appliance repairs and replacements

- Cosmetic improvements like painting

These fees are mandatory, and you must pay them even if you don’t use the property.

The Reality Check

Many timeshare owners face the harsh reality of escalating costs and depreciating property values. For instance, a study found that 85% of timeshare owners regret their purchase due to these financial burdens. This feeling of being trapped in a perpetual financial commitment leads many to seek ways to cancel my timeshare mortgage.

Timeshare ownership can be a double-edged sword. While it promises idyllic vacations, the financial and contractual obligations can quickly become overwhelming. Understanding these aspects is the first step toward making an informed decision about your timeshare mortgage.

Next, we’ll explore how to cancel your timeshare mortgage, including using the rescission period and seeking legal assistance.

How to Cancel My Timeshare Mortgage

Using the Rescission Period

One of the quickest ways to cancel my timeshare mortgage is by taking advantage of the rescission period. This is a brief window of time where you can legally cancel your timeshare contract without any penalties. Each state has different laws regarding the length of this period. For instance, states like Kansas and Ohio offer a minimum of three days, while Alaska provides 15 days.

How to Use the Rescission Period:

- Check State Laws: The rescission period is based on where your timeshare is located, not where you live. So, verify the specific laws in the state of your timeshare.

- Review Your Documents: Look for the public offering statement or timeshare disclosure. This document often triggers the start of the rescission period.

- Write a Cancellation Letter: Clearly state that you are canceling the contract. Include your name, contact details, timeshare description, purchase date, and a clear statement of cancellation.

- Send via Certified Mail: Use USPS certified mail to ensure the resort receives your letter. This provides proof of your cancellation request.

Legal Assistance

When the rescission period is not viable, legal assistance can help. Timeshare contracts often have complex terms that can be challenged under consumer protection laws.

How Legal Assistance Can Help:

- Hire a Contract Law Attorney: An experienced attorney (we have many at Lonestar) can review your contract for any inconsistencies or fraudulent practices.

- Use Consumer Protection Laws: Attorneys can leverage laws against deceit, misinformation, and high-pressure sales tactics to negotiate your release.

- Negotiation Strategies: Skilled attorneys can negotiate with the developer to cancel your mortgage or reduce your financial obligations.

Selling Your Timeshare

Another option is to sell your timeshare, though this can be challenging due to the over-saturated resale market.

Resale Market Challenges:

- Listing Sites: You can list your timeshare on platforms like Craigslist or Redweek.com. However, be prepared for potential fees and a long wait.

- Finding Buyers: Timeshares often sell for much less than the original purchase price. Some even go for as little as $1. This leaves you upside down in the timeshare, by a considerable amount.

- Financial Loss: Selling your timeshare might result in a financial loss, but it can help you escape ongoing maintenance fees and other costs.

Many people feel trapped by their timeshare commitments, but there are ways to cancel my timeshare mortgage. Whether through the rescission period or legal assistance, understanding your options is crucial.

Next, let’s look at the specific steps you can take to cancel your timeshare mortgage, starting with a free consultation.

Steps to Cancel Your Timeshare Mortgage

Free Consultation

The first step to cancel my timeshare mortgage is a free consultation. This initial assessment is crucial because it helps determine your eligibility for cancellation. At Lonestar Transfer, we provide a no-obligation consultation where our specialists gather necessary documentation and assess your situation. This is a no-risk way to understand your options better.

Document Review

Once you’ve had your free consultation, the next step is a thorough document review. Our team of analysts and attorneys will meticulously examine your timeshare contract. This involves identifying any inconsistencies, potential misrepresentations, or exploitable clauses. The goal is to build a robust legal strategy tailored to your specific needs.

- Contract Examination: Every clause is scrutinized to understand its implications.

- Identifying Inconsistencies: We look for any misleading information or deceptive practices.

- Legal Strategy: Based on the findings, a customized legal strategy is developed.

Legal Representation

After the document review, you will be assigned an experienced attorney to represent you. Legal representation is crucial in navigating the complexities of timeshare cancellation.

- Attorney Assignment: Each client undergoes a legal review specifically looking at consumer protection laws.

- Negotiation: Your attorney will negotiate directly with the timeshare company to cancel your mortgage and end all obligations.

- Court Proceedings: If necessary, your attorney will represent you in court to ensure a successful cancellation.

Credit Protection

One of the biggest concerns for timeshare owners is the impact on their credit score. At Lonestar Transfer, we offer comprehensive credit protection throughout the cancellation process.

- Credit Score Impact: We take steps to ensure the timeshare developer cannot negatively affect your credit score during the cancellation.

- Credit Repair: Our team works to repair any existing damage to your credit caused by the timeshare.

- IRS Form 1099-C: We also handle the tax implications of debt cancellation, ensuring you are compliant with IRS regulations.

Navigating the process to cancel my timeshare mortgage can be complex, but each step—from the free consultation to credit protection—is designed to make it as smooth as possible. Next, let’s dive into some frequently asked questions about timeshare mortgage cancellation.

Frequently Asked Questions about Timeshare Mortgage Cancellation

What happens if I don’t pay my timeshare mortgage?

Not paying your timeshare mortgage can lead to serious consequences. Just like any other mortgage, defaulting on payments can result in foreclosure. This means the timeshare company can take legal action to repossess the property.

Foreclosure can be either judicial or non-judicial, depending on state laws. Judicial foreclosures require a court order, while non-judicial foreclosures follow state-specific procedures. Both types can result in the timeshare company taking ownership of the property and selling it to recover the debt.

Credit Impact: Foreclosures are public records, and credit bureaus often find and report them. This can significantly damage your credit score, typically dropping it by 100 points or more. This negative mark can stay on your credit report for up to seven years, making it difficult to obtain loans, credit cards, or even rent an apartment.

Legal Consequences: Besides foreclosure, you may also face additional fees, such as late charges, attorney fees, and unpaid assessments. These costs can add up, further complicating your financial situation.

Can you legally get out of a timeshare contract?

Yes, you can legally get out of a timeshare contract, but it requires understanding the options available to you. Even if you are out of your recession period, Lonestar Transfer can still get you out, guaranteed.

Rescission Period: Most states have a rescission period—a short window (usually 3-15 days) during which you can cancel the contract without penalty. This period varies by state, so it’s crucial to act quickly if you’re within this timeframe. You must notify the seller in writing, following the specific instructions in your contract.

State Laws and Legal Grounds: If the rescission period has passed, you may still have legal grounds for cancellation. For example, if the timeshare company engaged in fraudulent behavior—like lying about interest rates, fees, or not disclosing the rescission period—you may have a case for cancellation. Consulting a contract law attorney can help you navigate these legal avenues.

How to get rid of a timeshare that is not paid off?

Getting rid of a timeshare with an outstanding mortgage balance can be challenging, but there are several strategies you can consider.

Legal Assistance: Hiring a contract law attorney can be beneficial. Attorneys can review your contract for inconsistencies or fraudulent claims, negotiate with the timeshare company, and represent you in court if necessary. Legal assistance can significantly increase your chances of a successful cancellation.

Resale Market: Selling your timeshare on the resale market is another option, though it comes with challenges. The market is often saturated, and you may have to sell at a significant loss. Websites like eBay, Craigslist, or specialized platforms like Redweek.com can help you list your timeshare. Be cautious of companies that charge high upfront fees and promise quick sales.

Navigating these options can be complex, but understanding them can help you make an informed decision. Next, we’ll explore the steps to take when you decide to cancel your timeshare mortgage.

Conclusion

Summary

Canceling a timeshare mortgage can be a complex and daunting task. From navigating legal intricacies to dealing with the emotional toll, it’s crucial to approach this process with a clear understanding and a well-thought-out strategy. Whether through the rescission period, deed-back programs, legal assistance, or selling your timeshare, there are multiple avenues to explore.

Financial Freedom

One of the greatest benefits of successfully canceling your timeshare mortgage is the financial freedom it provides. No more annual maintenance fees, unexpected special assessments, or high-interest mortgage payments. Imagine the relief of not having these financial burdens hanging over your head.

Peace of Mind

Beyond the financial aspects, canceling your timeshare mortgage can bring immense peace of mind. You no longer have to stress about unused vacation weeks, escalating costs, or the possibility of passing these obligations onto your heirs. Your vacations can become truly carefree again, allowing you to travel where you want, when you want.

Lonestar Transfer

At Lonestar Transfer, we specialize in helping timeshare owners break free from unwanted commitments. Our attorney-driven services are designed to provide tailored solutions that meet your unique needs. With over 25,000 clients successfully freed from their timeshare burdens, our track record speaks for itself.

If you’re ready to take the first step towards financial freedom and peace of mind, contact Lonestar Transfer today for a free consultation. Our expert team is here to guide you through every step of the timeshare mortgage cancellation process.