When considering estate planning, many people overlook a significant asset: their timeshare. Do timeshares transfer on death? In short, yes, timeshares do transfer upon an owner’s death, becoming part of their estate. This means that timeshares can provide cherished vacation memories for generations, but it’s crucial to plan accordingly to avoid leaving loved ones with unwanted financial burdens.

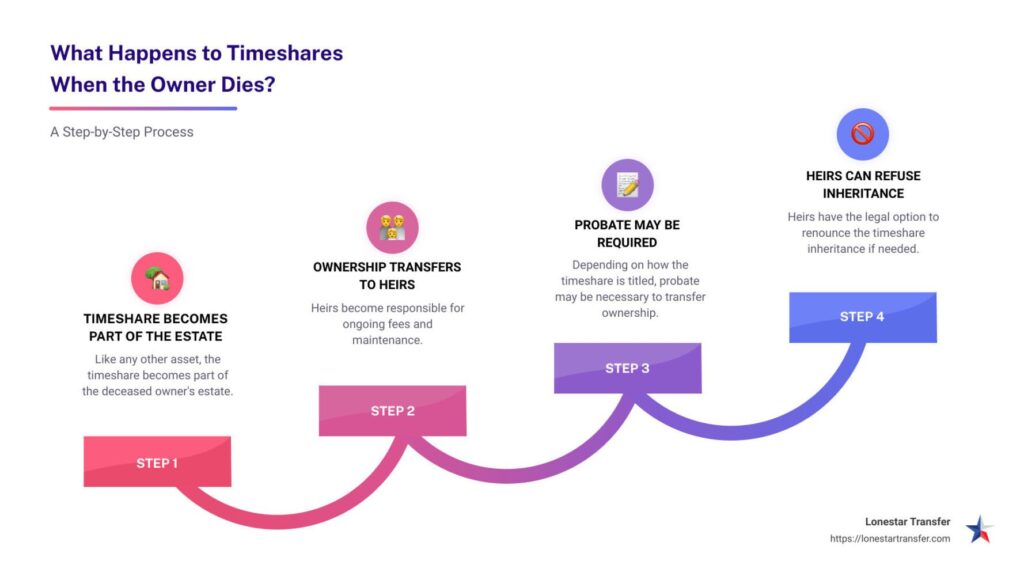

Here’s a quick snapshot of what happens to timeshares when an owner dies:

- Timeshares become part of the estate, like any other asset.

- Ownership transfers to heirs, who become responsible for ongoing fees.

- Probate may be required, depending on how the timeshare is titled.

- Heirs can refuse the inheritance, but should follow legal processes.

Let’s delve deeper into the importance of including your timeshare in your estate planning. Proper planning ensures your heirs know their options and responsibilities, avoiding unexpected financial consequences. By understanding your timeshare agreement, you can make informed decisions and safeguard a smooth transition for your loved ones.

Need help with getting out of a timeshare? Contact Lonestar Transfer today for expert advice!

What Happens to Timeshares When the Owner Dies?

When a timeshare owner passes away, the timeshare doesn’t just vanish. It becomes part of the deceased owner’s estate, similar to other assets like homes or cars. Let’s break down the process and what it means for the heirs.

Understanding the Perpetuity Clause

Most timeshare agreements come with a perpetuity clause. This legal clause states that the ownership of the timeshare extends beyond the owner’s life. When the owner dies, the timeshare is transferred to their estate. This means the next-of-kin or designated beneficiaries inherit not only the timeshare but also its associated responsibilities, such as maintenance fees.

Example: If you bought a timeshare with a perpetuity clause, your children or other heirs will inherit the timeshare and its obligations after your death. They can’t just ignore the fees and responsibilities tied to it.

The Role of Probate in Timeshare Transfer

The probate process is the legal procedure through which a deceased person’s will is validated and their assets are distributed. Timeshares, like other assets, often go through probate unless specific steps are taken to avoid it.

Probate Court and Executor Responsibilities

Once the owner dies, the timeshare is subject to probate. The probate court oversees the process, and the executor of the estate (the person named in the will to manage the estate) is responsible for ensuring that all debts, including maintenance fees for the timeshare, are paid during this period.

During probate, the executor must:

- Pay outstanding fees and debts associated with the timeshare.

- Manage the property, ensuring it is maintained.

- Distribute the asset according to the will or state law if there is no will.

Asset Distribution

After the probate process, the timeshare is distributed to the heirs as specified in the will. If there is no will, state laws determine who inherits the property. The new owners then take on all responsibilities, including paying ongoing fees.

Important Note: During probate, beneficiaries cannot use the timeshare. This can add to the financial burden, as fees must still be paid even if the property is not being used.

Need help navigating the probate process for a timeshare?Contact Lonestar Transfer for expert guidance!

Including Timeshares in Your Will

To ensure a smooth transition, it’s crucial to include clear instructions about the timeshare in your will. Specify who should inherit it and outline any wishes regarding its use or sale. This helps avoid confusion and potential disputes among heirs.

Alternatives to Wills for Timeshare Transfer

While a will can help, there are other estate planning tools that can make the process easier:

- Revocable Living Trust: Placing the timeshare in a trust can help avoid probate altogether. The trust becomes the owner of the timeshare, and the terms of the trust dictate how it is managed and transferred.

- Joint Tenants: Adding a beneficiary as a joint tenant can also bypass probate, but it comes with its own set of complications, such as creditor claims.

Example: If you place your timeshare in a revocable living trust, the trust owns the property, and upon your death, the trust’s terms dictate how the timeshare is handled. This avoids probate and can streamline the transfer process.

Don’t let your timeshare become a burden for your heirs. Learn more about your options.

By understanding these elements, you can better prepare your estate plan and ensure a smoother transition for your loved ones. Proper planning can save time, money, and stress for everyone involved.

Can You Refuse to Inherit a Timeshare?

Absolutely, you can refuse to inherit a timeshare. This is known as renunciation of property. It’s a legal process that allows you to decline the inheritance. While state laws can vary, the steps are generally similar. Here’s how you can do it:

Steps to Renounce a Timeshare Inheritance

- Act Quickly

- Do not delay. You only have a limited time to renounce the timeshare. If you wait too long, you might lose the right to refuse it.

- Prepare a Renunciation Document

- Description of the timeshare property: Clearly describe the property you are renouncing.

- Formal statement: Declare your intention to renounce the timeshare.

- Signature: Include your name and signature.

- Make several copies of this document.

- Send the Renunciation Document

- Send copies via Certified Mail to the timeshare company and the Executor of the estate. Keep a copy for your records.

- File with the Probate Court

- If the estate is in probate, file a copy of the renunciation document with the probate court. This ensures your renunciation is legally recognized.

Potential Consequences of Renunciation

Renouncing a timeshare inheritance can have several consequences:

- Foreclosure: If no one inherits the timeshare, it may go into foreclosure. The timeshare company may take back the property.

- Estate Debt: Any unpaid fees or debts related to the timeshare may be paid from the estate’s assets, if available.

- Credit Impact: Generally, the heirs will not suffer credit damage if the renunciation is done correctly. However, it’s crucial to follow all legal steps to avoid complications.

You can always consult with a legal expert to ensure you’re following your state’s specific laws and procedures.

Need help with your timeshare estate planning? Contact Lonestar Transfer today for expert advice!

By taking these steps, you can avoid inheriting an unwanted timeshare and the associated financial burdens. Proper renunciation can save you from future headaches and ensure a smoother estate settlement process.

How to Protect Your Timeshare in Your Estate Plan

Using a Revocable Living Trust

One of the best tools for protecting your timeshare in your estate plan is a Revocable Living Trust. This tool helps you avoid the hassle of probate and can even offer tax benefits.

Benefits of a Revocable Living Trust:

- Avoids Probate: When you place your timeshare in a trust, it becomes the trust’s property. This means it won’t go through the probate process, saving your heirs time and money.

- Tax Benefits: Depending on your situation, a trust can offer tax advantages. Consult a tax advisor to understand how this might apply to you.

- Flexibility: You can make changes to a revocable trust during your lifetime. This allows you to adjust your estate plan as circumstances change.

- Control: You maintain control over the timeshare while you’re alive. You can still use it, rent it out, or even sell it if you wish.

How to Set Up a Revocable Living Trust:

- Consult an Estate Planning Attorney: They can help you draft the trust document, ensuring it meets legal requirements.

- Transfer the Timeshare Into the Trust: This involves changing the ownership from your name to the trust’s name. Your attorney can guide you through this process.

- Name Beneficiaries and Trustees: Specify who will manage the trust after you pass away and who will inherit the timeshare.

Example:

Jane, a timeshare owner, set up a revocable living trust and included her timeshare in it. When she passed away, her heirs avoided probate, and the timeshare transferred smoothly to her designated beneficiary.

Ready to secure your timeshare’s future? Reach out to Lonestar Transfer for a consultation now!

Titling as Joint Tenants

Another option is to title your timeshare as Joint Tenants with Right of Survivorship. This means that if you pass away, ownership automatically transfers to the surviving joint tenant without going through probate.

Benefits of Joint Tenancy:

- Avoids Probate: Like a trust, joint tenancy can help you avoid the probate process.

- Simplicity: It’s straightforward to set up. You just need to add the joint tenant’s name to the timeshare deed.

Potential Complications:

- Loss of Control: Adding someone as a joint tenant means they have equal ownership rights. They can make decisions about the property, including selling it.

- Creditor Risks: If the joint tenant has debt issues, creditors could place claims on the timeshare.

- Tax Implications: Adding a joint tenant can have gift tax implications. Consult a tax advisor to understand the potential impact.

Example:

John added his daughter as a joint tenant on his timeshare. When he passed away, she automatically became the sole owner. However, she found it challenging to manage the timeshare due to her own financial difficulties.

By understanding these estate planning tools, you can make informed decisions to protect your timeshare and ensure it transfers smoothly to your heirs. Whether you choose a revocable living trust or joint tenancy, each option has its benefits and potential complications.

If you inherited a timeshare that has become a burden, learn more about your options with Lonestar Transfer.

Conclusion

Managing a timeshare after the owner’s death can be complex, but understanding your options can make the process smoother. Whether it’s including the timeshare in your will, using a revocable living trust, or even renouncing the inheritance, there are several ways to handle this unique asset.

At Lonestar Transfer, we specialize in helping clients navigate the intricacies of timeshare ownership and estate planning. Our goal is to ensure that your timeshare doesn’t become a burden for your heirs.

Need help with getting out of your timeshare? Contact Lonestar Transfer today for expert advice!

If your love one didn’t plan ahead, we can help you get rid of your inherited timeshare legally and permanently.